All Categories

Featured

Table of Contents

Note, nevertheless, that this does not say anything regarding readjusting for rising cost of living. On the plus side, even if you presume your option would certainly be to purchase the stock exchange for those 7 years, and that you would certainly obtain a 10 percent yearly return (which is much from certain, particularly in the coming decade), this $8208 a year would be greater than 4 percent of the resulting nominal stock worth.

Example of a single-premium deferred annuity (with a 25-year deferment), with 4 repayment alternatives. The monthly payment right here is greatest for the "joint-life-only" option, at $1258 (164 percent greater than with the instant annuity).

The way you acquire the annuity will certainly identify the response to that question. If you get an annuity with pre-tax dollars, your costs lowers your gross income for that year. However, ultimate repayments (month-to-month and/or round figure) are strained as routine income in the year they're paid. The benefit right here is that the annuity might let you postpone taxes beyond the internal revenue service contribution restrictions on IRAs and 401(k) strategies.

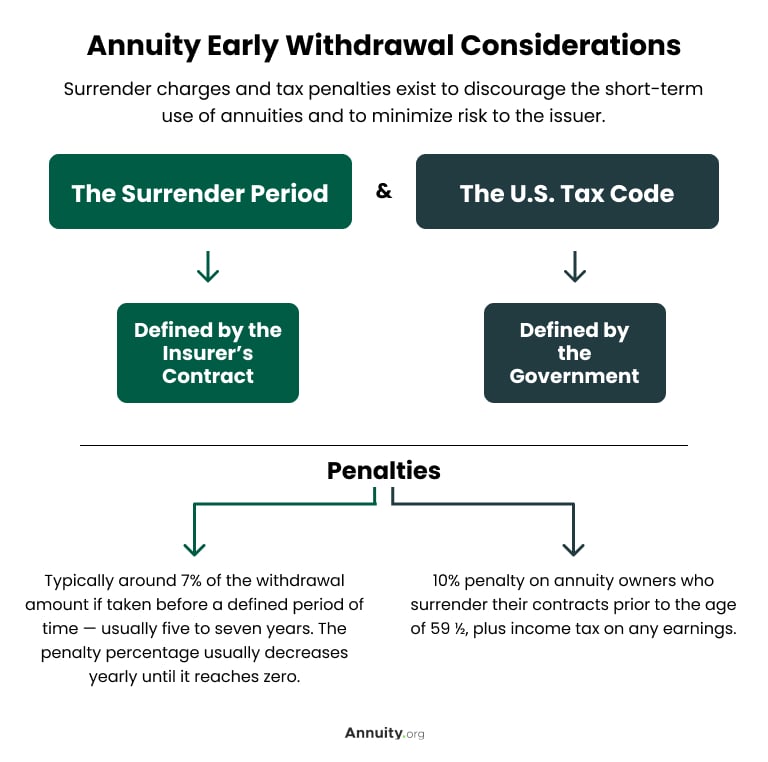

According to , purchasing an annuity inside a Roth strategy leads to tax-free repayments. Buying an annuity with after-tax bucks outside of a Roth leads to paying no tax obligation on the section of each payment attributed to the initial costs(s), yet the remaining portion is taxable. If you're establishing up an annuity that begins paying prior to you're 59 years old, you might need to pay 10 percent early withdrawal penalties to the IRS.

What does an Annuities For Retirement Planning include?

The advisor's very first step was to establish an extensive economic prepare for you, and then discuss (a) exactly how the proposed annuity fits right into your total strategy, (b) what options s/he thought about, and (c) exactly how such choices would certainly or would certainly not have led to reduced or higher settlement for the advisor, and (d) why the annuity is the superior choice for you. - Annuity income

Obviously, a consultant may attempt pushing annuities even if they're not the very best suitable for your circumstance and objectives. The factor could be as benign as it is the only item they sell, so they fall victim to the typical, "If all you have in your tool kit is a hammer, rather quickly everything begins appearing like a nail." While the expert in this circumstance may not be dishonest, it increases the danger that an annuity is an inadequate option for you.

What is an Long-term Care Annuities?

Because annuities frequently pay the agent marketing them much greater payments than what s/he would certainly receive for spending your cash in shared funds - Immediate annuities, not to mention the absolutely no compensations s/he 'd obtain if you purchase no-load mutual funds, there is a large motivation for agents to press annuities, and the much more challenging the better ()

A dishonest advisor recommends rolling that amount right into new "far better" funds that just occur to lug a 4 percent sales load. Consent to this, and the expert pockets $20,000 of your $500,000, and the funds aren't most likely to execute much better (unless you chose also more improperly to start with). In the exact same example, the expert might guide you to get a complex annuity keeping that $500,000, one that pays him or her an 8 percent commission.

The expert hasn't figured out exactly how annuity payments will be tired. The expert hasn't revealed his/her settlement and/or the fees you'll be charged and/or hasn't shown you the impact of those on your ultimate payments, and/or the payment and/or costs are unacceptably high.

Existing interest prices, and therefore predicted payments, are traditionally low. Also if an annuity is appropriate for you, do your due persistance in comparing annuities sold by brokers vs. no-load ones marketed by the providing business.

What is an Immediate Annuities?

The stream of monthly payments from Social Protection is comparable to those of a delayed annuity. Actually, a 2017 relative evaluation made an in-depth comparison. The following are a few of the most salient factors. Since annuities are voluntary, the individuals purchasing them normally self-select as having a longer-than-average life span.

Social Safety and security advantages are totally indexed to the CPI, while annuities either have no rising cost of living protection or at most provide a set portion annual increase that might or may not make up for inflation completely. This type of biker, similar to anything else that enhances the insurance company's threat, requires you to pay more for the annuity, or accept reduced payments.

Deferred Annuities

Please note: This article is intended for informative purposes just, and must not be taken into consideration monetary guidance. You ought to speak with a monetary expert prior to making any type of significant economic decisions.

Considering that annuities are planned for retirement, tax obligations and charges might use. Principal Protection of Fixed Annuities. Never ever lose principal as a result of market performance as taken care of annuities are not invested in the market. Even throughout market declines, your money will not be influenced and you will not shed money. Diverse Investment Options.

Immediate annuities. Made use of by those that desire reputable income quickly (or within one year of acquisition). With it, you can customize earnings to fit your requirements and develop earnings that lasts for life. Deferred annuities: For those who desire to expand their cash gradually, yet want to defer access to the cash until retirement years.

What should I look for in an Tax-deferred Annuities plan?

Variable annuities: Provides greater possibility for development by spending your cash in investment choices you choose and the capacity to rebalance your portfolio based upon your preferences and in a means that aligns with changing economic objectives. With repaired annuities, the firm spends the funds and provides a passion rate to the client.

When a death insurance claim accompanies an annuity, it is important to have a named recipient in the agreement. Different options exist for annuity survivor benefit, relying on the contract and insurance firm. Selecting a reimbursement or "duration specific" alternative in your annuity gives a survivor benefit if you pass away early.

What does an Annuity Accumulation Phase include?

Naming a beneficiary besides the estate can help this procedure go more efficiently, and can help make sure that the profits most likely to whoever the private desired the cash to head to rather than undergoing probate. When present, a fatality advantage is automatically consisted of with your contract. Relying on the kind of annuity you purchase, you may have the ability to include improved fatality benefits and functions, however there could be added prices or fees related to these add-ons.

Table of Contents

Latest Posts

Exploring Choosing Between Fixed Annuity And Variable Annuity A Comprehensive Guide to Investment Choices What Is Fixed Indexed Annuity Vs Market-variable Annuity? Pros and Cons of Fixed Indexed Annui

Highlighting Fixed Annuity Vs Variable Annuity A Closer Look at Retirement Income Fixed Vs Variable Annuity What Is Pros And Cons Of Fixed Annuity And Variable Annuity? Benefits of Fixed Annuity Or Va

Exploring the Basics of Retirement Options A Closer Look at How Retirement Planning Works Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Fixed Index Annuity Vs Variable A

More

Latest Posts